Business Insurance in and around Holly

Calling all small business owners of Holly!

Cover all the bases for your small business

Business Insurance At A Great Price!

Do you own an ice cream shop, a sporting good store or a pet groomer? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on what matters most.

Calling all small business owners of Holly!

Cover all the bases for your small business

Small Business Insurance You Can Count On

When one is as driven about their small business as you are, it is understandable to want to make sure all bases are covered. That's why State Farm has coverage options for commercial auto, business owners policies, surety and fidelity bonds, and more.

Let's discuss business! Call Mark Carney today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

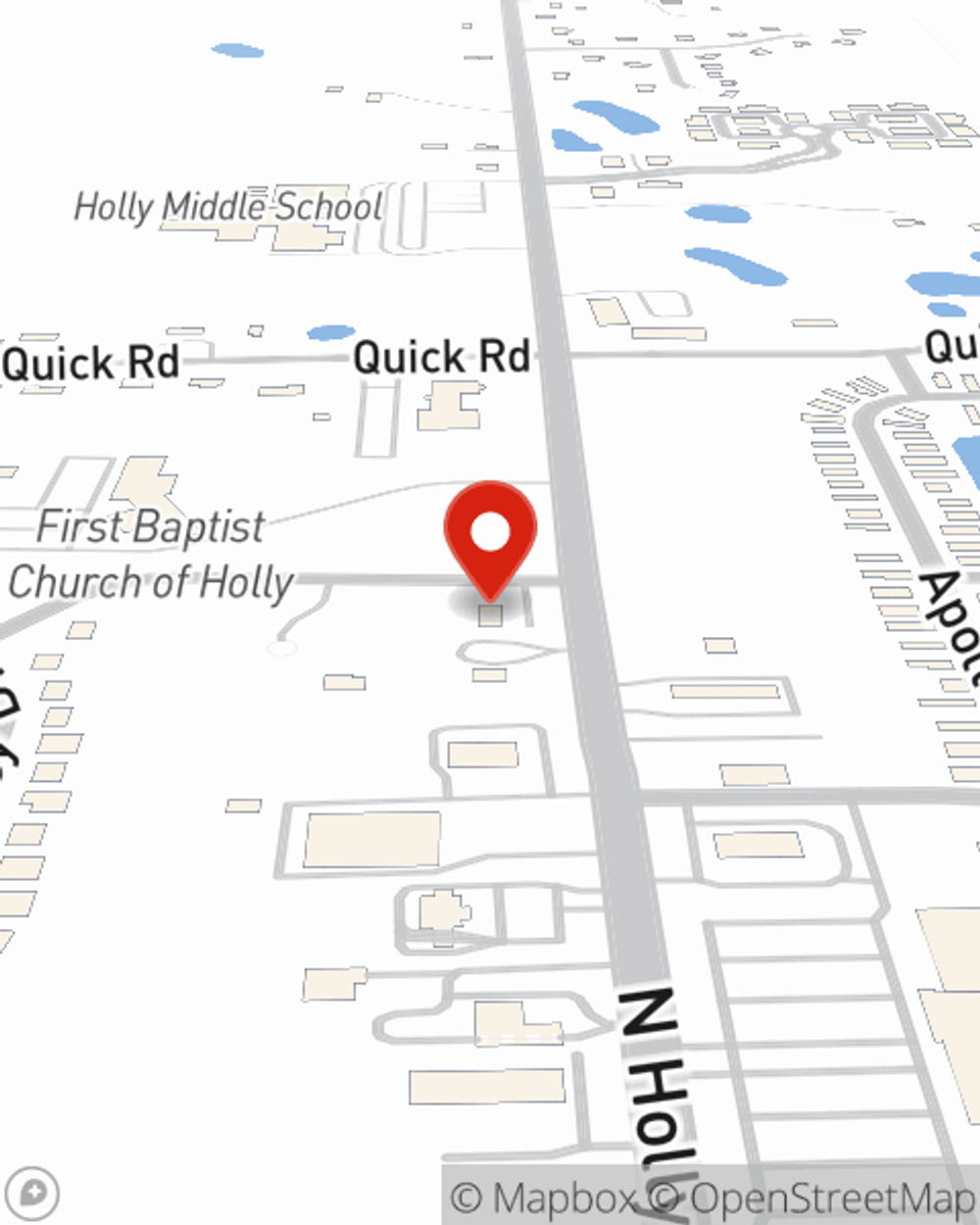

Mark Carney

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.